Paying for orthodontic treatment like Invisalign or braces can be a big investment, but did you know some of those costs may be tax deductible in Canada?

If you’re wondering, “can you claim orthodontics on taxes in Canada?” the answer is yes, but there are a few key rules to understand first. Not all dental expenses are eligible, and what you can claim depends on your income, who paid, and whether the treatment was medically necessary. Only certain medical expenses, such as orthodontic braces for corrective purposes, qualify for tax deductions.

Let’s break down how the Canadian tax system treats orthodontics, what counts as an eligible medical expense, and how to properly claim it on your return.

Introduction to Dental Expenses

Dental expenses can be a significant part of your annual healthcare costs, but the good news is that many of these expenses are tax deductible in Canada. The Canada Revenue Agency (CRA) recognizes a wide range of dental expenses as eligible medical expenses, which means you may be able to claim them through the Medical Expense Tax Credit (METC) on your income tax return. By understanding which dental expenses qualify and how to claim them, you can reduce your taxable income and potentially lower the amount of income tax you owe. Whether you’re paying for routine dental care, major dental work, or orthodontic treatments, knowing the basics of dental expenses and the tax credit system can help you make the most of your tax return.

What Is the Medical Expense Tax Credit?

The Medical Expense Tax Credit (METC) is a non-refundable tax credit offered by the Canada Revenue Agency (CRA). It allows Canadians to claim certain medical and dental expenses, including orthodontics, on their personal income tax return to reduce the amount of federal tax owed. To claim medical expenses, you must keep proper documentation, such as receipts and supporting records, to submit with your tax return. The CRA has specific eligibility criteria for claiming medical expenses, including that the expenses must be medically necessary, not reimbursed, and meet the requirements set by the agency.

To qualify, your total eligible medical expenses must exceed the lesser of:

- 3% of your net income, or

- a fixed dollar threshold set by the CRA for that tax year

Only the portion above that threshold qualifies for the credit. The calculation is based on eligible expenses minus the lesser of 3% of your net income or the fixed dollar threshold. If you have a lower net income, you’re more likely to benefit from this credit. Understanding the eligibility criteria and documentation required is essential for successfully claiming medical expenses.

Are Orthodontic Expenses Tax Deductible in Canada?

Yes, most orthodontic treatments are considered eligible medical expenses, as long as they are prescribed by a dental professional for medical reasons (not just cosmetic purposes).

You can claim:

- Invisalign and other clear aligners

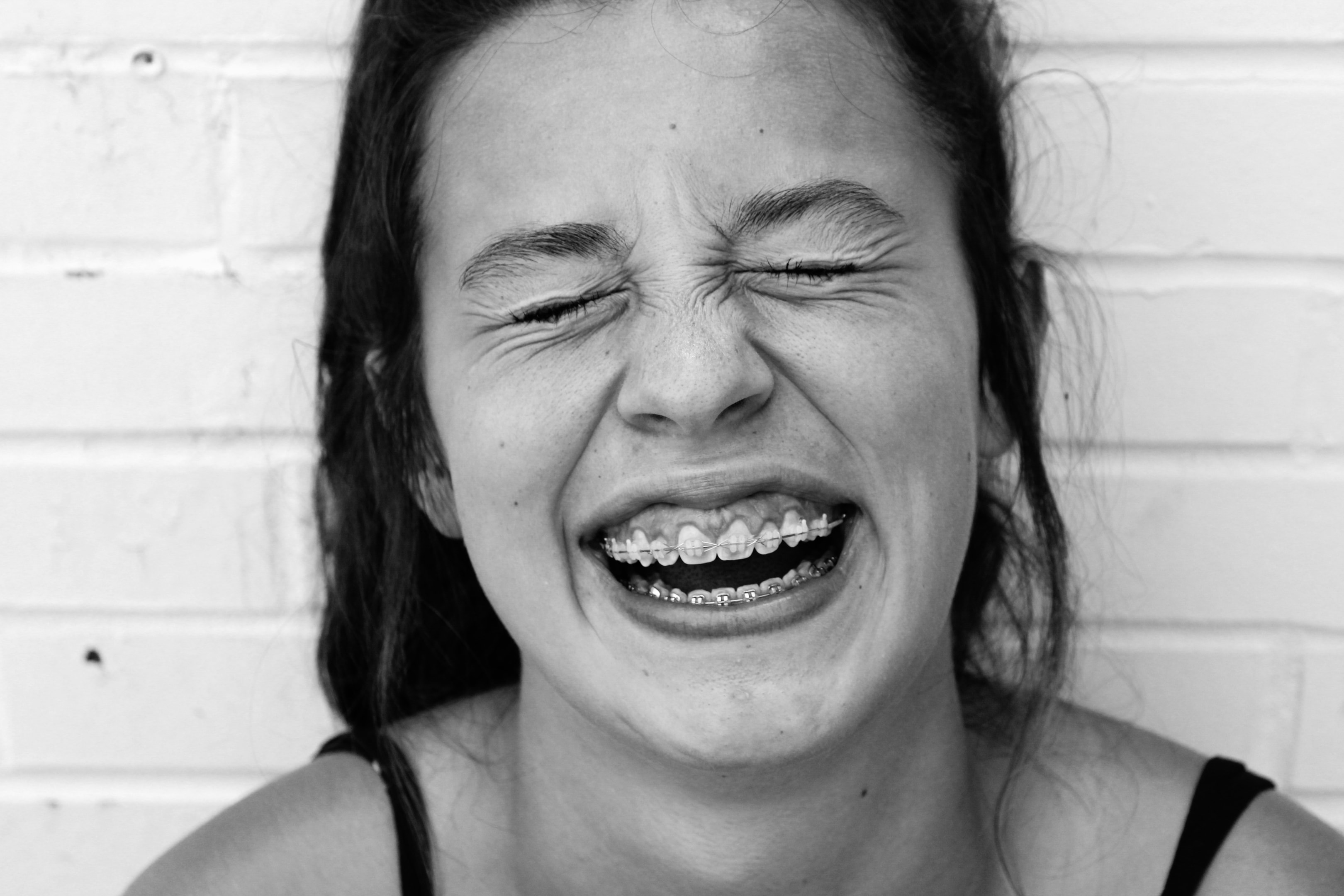

- Metal or traditional braces

- Retainers and dental appliances

- Related orthodontic assessments or imaging

- Certain dental implants

- A variety of dental procedures, such as fillings, dentures, and implants, may also qualify if they are medically necessary

Dental services, including orthodontics, dental implants, and dentures, are generally considered eligible for tax deductions.

Teeth whitening and cosmetic procedures are not eligible. Only medically necessary dental treatments are eligible, and cosmetic dental procedures are excluded. The CRA generally requires that the treatment is to correct an existing dental issue, not purely for appearance. Invisalign is tax deductible in Canada when prescribed for medical reasons.

Understanding Net Income and Expenses

When it comes to claiming dental expenses, your net income plays a key role in determining how much you can claim. Net income, which you’ll find on line 23600 of your tax return, is used by the CRA to set a threshold for eligible medical expenses. To qualify for the Medical Expense Tax Credit, your total eligible medical expenses, including dental expenses, must exceed the lesser of $2,479 or 3% of your net income for the tax year. This means it’s important to keep a detailed record of all your medical and dental expenses throughout the year. By tracking your total eligible medical expenses, you can ensure you meet the threshold and maximize the tax credit available to you when you claim dental expenses on your tax return.

Who Can Claim Orthodontic Expenses?

You can claim eligible expenses paid for:

- Yourself

- Your spouse or common-law partner

- Your dependent children under 18

- Other dependents (like a parent or sibling), provided they meet CRA’s income and dependency rules

When claiming expenses for a dependent, the dependant’s net income is used to determine eligibility and claim limits.

Important: You can only claim expenses you or your spouse/common-law partner actually paid, even if the treatment was for someone else. If your common law partner paid for the expenses, only they can claim the deduction. If a parent, child, or partner paid directly, they would need to claim it on their return instead.

Invisalign and Other Orthodontic Treatments: Are They Tax Deductible?

If you’re considering Invisalign or other orthodontic treatments, you’ll be pleased to know that these are generally considered eligible medical expenses and are tax deductible in Canada. The Medical Expense Tax Credit allows you to claim the cost of orthodontic treatments that are medically necessary to improve your oral health and dental function, not just for cosmetic reasons. To take advantage of this tax credit, make sure you keep all receipts and documentation provided by your dental professional. By claiming these eligible medical expenses, you can reduce your taxable income and potentially lower your income tax bill, making orthodontic treatments like Invisalign more affordable in the long run.

What About Insurance Reimbursements?

If you have dental insurance or a private health services plan that reimbursed a portion of your orthodontic expenses, you can only claim the amount you personally paid out-of-pocket. Be sure to confirm with your insurance company what is covered under your insurance coverage before proceeding with treatment.

So, if Invisalign treatment cost $7,000 and insurance covered $3,000, you can only claim $4,000 on your taxes.

Many group insurance plans issue annual tax slips showing medical/dental premiums paid, which may also qualify for a separate deduction. However, most group insurance plans do not cover the full cost of dental expenses, so it’s important to understand your insurance coverage and what portion is eligible for tax deduction.

What You’ll Need to Claim it

To claim orthodontic expenses on your Canadian tax return, make sure you have: All dental expenditures and dental costs should be included when preparing your claim to ensure you claim dental expenditures accurately.

- Receipts that show amounts paid, date of payment, and provider details

- The name of the person who received treatment

- Proof that the treatment was medically necessary (if requested)

- A clear breakdown of what insurance covered (if applicable)

- Documentation for all dental expenditures to support your medical expenses claim

Proper documentation is essential to maximize your medical expense deductions and receive the maximum benefit from your claim.

Use Line 33099 or 33199 on your tax return, depending on whether the expense is for yourself, your spouse, or another dependent. If you’re unsure, consult a tax professional for personalized guidance. Seeking professional tax advice can help ensure you claim dental expenditures correctly and maximize your tax savings.

Audit and Verification: What to Expect

If you claim dental expenses on your tax return, the Canada Revenue Agency may select your return for audit or verification. This is a routine process to ensure that all claims for the tax credit are accurate and supported by proper documentation. To prepare, keep all receipts, invoices, and statements from your dental provider organized and accessible. The CRA may request these documents to confirm the amounts you claimed for dental expenses. By maintaining thorough records, you can respond quickly to any requests and help ensure your claim for the tax credit is processed smoothly.

Final Tips for Maximizing Your Claim

To get the most out of your dental expense claim, it’s important to know which costs qualify as eligible medical expenses. Most dental expenses, such as dental implants, orthodontic treatments, and routine dental care, are eligible for the Medical Expense Tax Credit. However, cosmetic procedures like teeth whitening are not considered eligible expenses. Keep all your receipts and supporting documents for at least six years, as the Canada Revenue Agency may review your claim during this period. If you’re unsure about which expenses you can claim or how to properly document them, consider consulting a tax professional. By staying informed, organized, and proactive, you can maximize your tax credit, reduce your income tax, and ensure you’re claiming all the eligible dental expenses you’re entitled to. For more information, the CRA website offers helpful resources and guidelines on claiming dental and other medical expenses on your tax return.

TL;DR – Can You Claim Orthodontics on Taxes in Canada?

- Yes, orthodontic treatments like Invisalign and braces are eligible medical expenses in most cases

- You can claim costs paid for yourself, your spouse, or eligible dependents

- Cosmetic procedures like teeth whitening are not eligible

- You can only claim out-of-pocket costs, not amounts reimbursed by insurance

- You’ll need detailed receipts and documentation to support your claim

Final Thoughts

While orthodontics can feel like a major cost, the Medical Expense Tax Credit can help soften the blow, especially for families or individuals with higher medical expenses in a given tax year. In addition to the Medical Expense Tax Credit, you may also be eligible for a tax deduction or other tax deductions if you have high medical expenses or low incomes. Working Canadians with low incomes and high medical expenses may also qualify for the refundable medical expense supplement, which provides additional support.

If you’re not sure what qualifies, or how to report the expense correctly, reach out to a tax specialist. With the right paperwork and a little planning, your new smile might come with a bit of a tax break, too.

Ready to learn more about your orthodontic options in Calgary? Reach out to InLine Orthodontics today and book your consultation.